AutomationLinks

This blog post has been researched, edited, and approved by expert Hannah Peake. Join our newsletter below to get our free marketing guides.

four simple marketing tips for your insurance company:

- Optimize Your Website for Mobile Users: With more people than ever accessing the internet via smartphones, ensuring your insurance company's website is mobile-friendly can significantly improve user experience and boost engagement rates.

- Engage Regularly on Social Media: Use social media platforms to connect with your audience by sharing helpful tips, industry news, and personalized responses to queries. This not only builds trust but also enhances your brand's visibility.

- Personalize Your Customer Communications: Implement CRM tools to tailor your communications based on customer data. Personalized emails, offers, and messages can greatly increase customer satisfaction and loyalty.

- Use Data to Drive Decisions:

Leverage analytics to understand customer behaviors and preferences. This data-driven approach allows for more targeted marketing campaigns, improving the effectiveness of your advertising spend.

Table of contents

- Kicking Things Off: Why Marketing in Insurance Can't Be Overlooked

- Understanding Your Target Audience

- Leveraging Digital Marketing

- Investing in Customer Relationship Management (CRM) Tools

- Utilizing Data and Analytics for Targeted Campaigns

- Building a Strong Online Reputation and Trust

- Conclusion: Wrapping It Up

Why Marketing in Insurance Can't Be Overlooked

Ever wonder how big the insurance industry really is? Well, it's massive, with global premiums soaring past the $5 trillion mark. In a market that's not just growing but also getting more competitive by the minute, sticking to old-school marketing methods just won't cut it anymore. Innovative marketing isn't a luxury; it's a necessity for those looking to make a mark. So, whether you're dealing in life, auto, or health insurance, the challenge remains the same: How do you stand out in a crowd this huge?

That's exactly what we're here to tackle. This piece isn't about throwing jargon at you or rehashing the same old strategies you've seen a dozen times. No, we're talking about real, practical marketing advice that's been tailored specifically for the insurance market. Whether you're running a tight-knit agency or leading a sprawling enterprise, our goal is to arm you with the kind of marketing insights that not only draw customers in but keep them engaged.

Connect With Us On X

Connect with AutomationLinks owner Brad Smith on X (formerly Twitter) here to learn more about advertising. Feel free to message him with any questions about X advertising and marketing.

Understanding Your Target Audience

Knowing your target audience is the cornerstone of any successful marketing campaign, especially in the insurance sector. This understanding goes beyond mere demographics; it's about diving deep into the needs, preferences, and behaviors of your potential customers. In an industry as diverse as insurance, where products range from health to auto, to home insurance, the one-size-fits-all approach simply doesn't cut it. Tailoring your messaging to address the unique concerns of each customer segment can significantly enhance engagement and conversion rates. By aligning your marketing strategies with the specific needs and preferences of your audience, you not only increase the relevance of your offerings but also build a stronger, more personal connection with potential clients.

Implementing personalization strategies in your marketing efforts can revolutionize how customers perceive and interact with your brand. In today's digital age, consumers expect brands to understand their individual needs and offer solutions that feel bespoke. For insurance companies, this could mean creating targeted content that addresses specific life stages or scenarios, using data analytics to predict customer needs before they arise, or tailoring communication channels to suit the preferences of different demographics. Embracing personalization not only elevates the customer experience but also sets your company apart in a crowded marketplace.

- Segment Your Audience: Use data analytics to segment your audience based on demographics, behaviors, and preferences. This allows for more targeted and relevant marketing messages.

- Create Buyer Personas: Develop detailed buyer personas for each customer segment. This will help you understand their specific needs and tailor your marketing strategies accordingly.

- Leverage Personalized Communication: Customize your communication channels and messages for different segments. Whether through personalized emails, targeted social media ads, or customized landing pages, ensure your message resonates with the individual needs of your audience.

- Feedback Loops: Implement mechanisms to gather feedback from your customers. This continuous loop of feedback and improvement helps refine your understanding of your audience over time, making your personalization efforts more effective.

Leveraging Digital Marketing

In the digital age, your online presence is often the first point of contact between your insurance company and potential customers. This makes website optimization not just a priority, but a necessity. A user-friendly website that's optimized for search engines does more than just attract visitors; it serves as a digital handshake, offering a first impression that can either open doors or close them. It's essential that your site is easy to navigate, provides valuable information, and is accessible on any device. SEO isn't just about keywords; it's about creating a seamless user experience that guides visitors smoothly from their initial inquiry to the decision to engage with your insurance services. By ensuring your website is optimized for both users and search engines, you're laying down the foundation of a digital marketing strategy that captures and retains interest.

Social media and content marketing are powerful tools that can significantly amplify your reach and establish your brand as a thought leader in the insurance industry. By engaging with potential customers on platforms where they already spend their time, you can build relationships and foster trust before they even need your services. Content marketing, on the other hand, allows you to share valuable insights, tips, and information that can help demystify insurance for your audience. This approach not only positions your company as helpful and knowledgeable but also drives organic traffic to your website through high-quality, SEO-optimized content. When used effectively, social media and content marketing can transform your online presence, making your insurance company the go-to source for insights and solutions in the industry.

- Optimize for Mobile: Ensure your website is mobile-friendly, as a significant portion of online traffic comes from mobile devices.

- Utilize SEO Best Practices: Implement SEO strategies, such as keyword research and meta descriptions, to improve your website's visibility on search engine results pages (SERPs).

- Engage on Social Media: Actively engage with your audience on social media platforms by responding to comments, sharing relevant content, and participating in industry-related conversations.

- Create Valuable Content: Produce and share content that addresses the common questions and concerns of your target audience. This can include blog posts, infographics, videos, and guides that provide real value.

- Track and Analyze: Use analytics tools to track the performance of your digital marketing efforts and make data-driven decisions to optimize your strategies further.

Investing in Customer Relationship Management (CRM) Tools

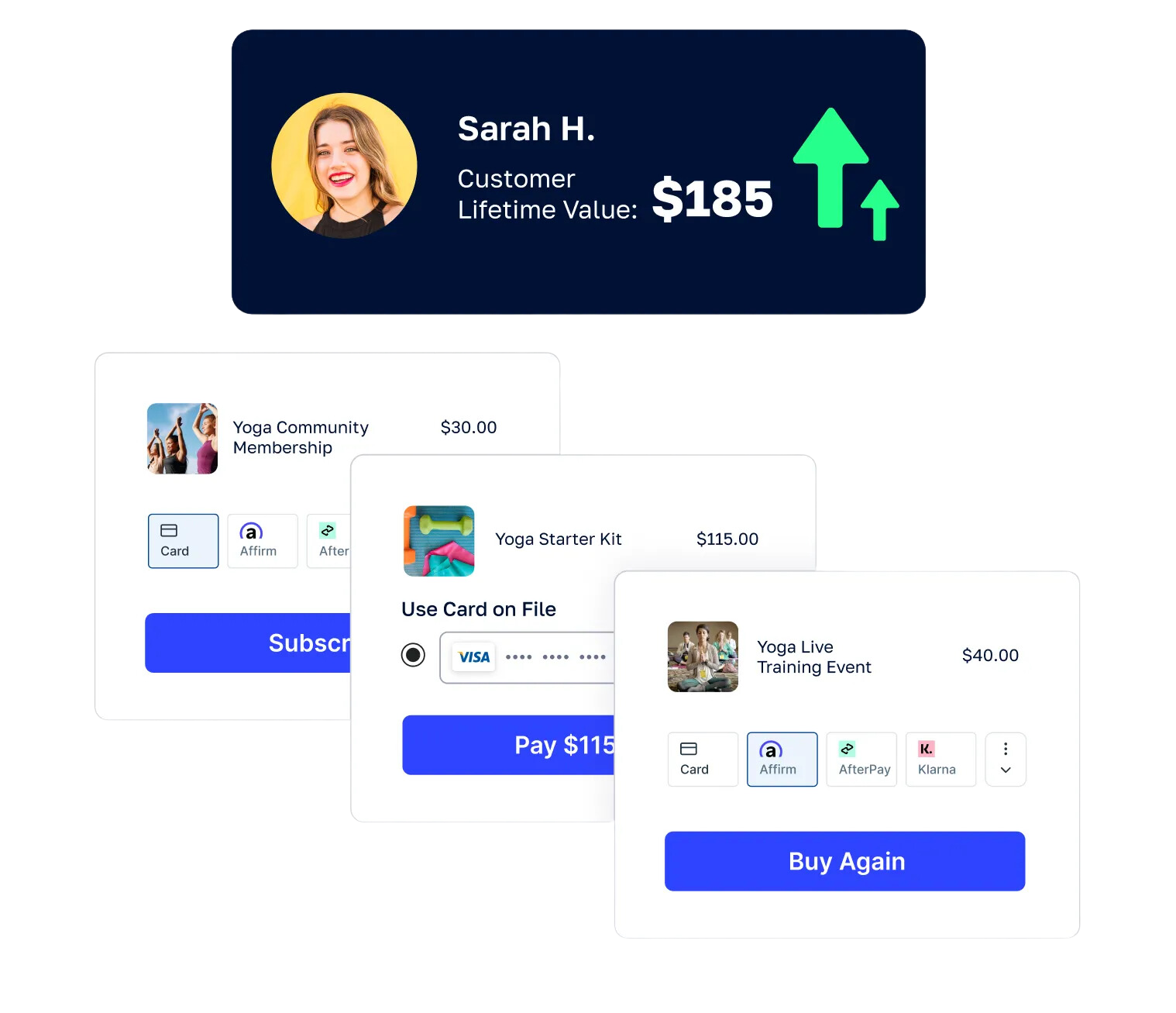

In the competitive landscape of the insurance industry, Customer Relationship Management (CRM) tools are not just advantageous—they're essential. These sophisticated platforms offer a treasure trove of benefits, central to which is their ability to manage and analyze customer interactions and data across the entire customer lifecycle. From prospecting to customer retention, CRMs provide a 360-degree view of the customer journey, enabling insurance companies to deliver personalized experiences at scale. The insights gleaned from CRM data analysis can inform strategic decisions, helping companies understand customer needs, preferences, and behavior patterns. This deep understanding allows for the delivery of timely, relevant content and offers, significantly enhancing customer satisfaction and loyalty.

The utility of CRM systems extends far beyond data management; they are powerful tools for streamlining marketing automation, improving customer service, and driving sales growth. For instance, marketing automation can be used to send personalized emails to clients based on specific triggers, such as policy renewals or birthday greetings, thereby increasing engagement and retention rates. On the customer service front, CRM tools within HubSpot can help manage inquiries and complaints more efficiently, ensuring that every customer interaction is tracked and resolved in a timely manner. This level of responsiveness and personal attention can greatly enhance the customer experience, setting your company apart from competitors. Additionally, CRMs can assist in identifying sales opportunities by analyzing customer data to predict future needs, making cross-selling and upselling efforts more targeted and effective.

- Automate Marketing Efforts: Use CRM tools to automate email campaigns and social media posts, ensuring that your marketing messages are delivered to the right people at the right time.

- Improve Customer Service: Leverage CRM databases to keep track of all customer interactions, providing your service team with the context they need to resolve issues efficiently and personalize their approach.

- Enhance Sales Strategies: Utilize CRM analytics to understand customer behavior and preferences, tailoring your sales pitches and product offerings to match the needs of different customer segments.

- Personalize Customer Experiences: Apply the insights gathered from CRM data to personalize the customer journey, from targeted marketing messages to customized service offerings.

- Track and Measure: Continuously monitor the effectiveness of your CRM strategies through built-in analytics and reporting features, allowing for ongoing optimization of your marketing, sales, and service efforts.

Utilizing Data and Analytics for Targeted Campaigns

In today's digital-first world, data and analytics are the lifeblood of effective marketing strategies, especially for insurance companies. The ability to collect, analyze, and act upon vast amounts of data enables businesses to make evidence-based decisions, ensuring that their marketing efforts are not just shots in the dark but strategic moves designed to hit specific targets. Utilizing data and analytics allows insurance marketers to understand their audience at a granular level, identify trends and patterns, and predict customer behavior. This depth of insight is invaluable for crafting campaigns that resonate deeply with potential and existing customers, significantly increasing the likelihood of conversion and customer retention. By grounding your marketing strategies in data, you're not only optimizing your budget but also enhancing the overall effectiveness and efficiency of your campaigns.

Campaign optimization is where data analytics truly shines. Through real-time monitoring and analysis, marketers can track the performance of their campaigns across various channels, identifying what works and what doesn't. This immediate feedback loop is crucial for adjusting strategies on the fly, whether it's tweaking a message, changing a call-to-action, or reallocating budget to higher-performing channels. Analytics tools can also uncover insights into customer engagement patterns, enabling marketers to tailor their approaches to different segments for better results. For insurance companies, this could mean adjusting content strategies based on the policy renewal cycle or launching targeted ads that address common concerns leading up to life milestones. By leveraging data analytics for campaign optimization, insurance marketers can ensure that their messages are always relevant, timely, and compelling.

- Set Clear KPIs: Define key performance indicators (KPIs) for each campaign to measure success and track progress toward your marketing objectives.

- Segment Your Data: Break down your data by demographics, behaviors, and interaction history to identify opportunities for targeted marketing.

- Test and Learn: Use A/B testing to experiment with different campaign elements, such as email subject lines or landing page designs, and use the results to inform future strategies.

- Leverage Predictive Analytics: Apply predictive analytics to forecast future customer behavior and tailor your marketing efforts accordingly.

- Monitor and Adjust in Real-Time: Keep a close eye on campaign performance metrics and be ready to make swift adjustments to optimize for better outcomes.

Building a Strong Online Reputation and Trust

In the insurance industry, trust is not just a commodity; it's the currency that fuels business growth and customer loyalty. With the digital transformation reshaping how companies interact with their customers, building a strong online reputation has become paramount. The power of online reviews, social proof, and transparent communication can significantly influence consumer choices, making it essential for insurance companies to actively manage and enhance their online presence. A robust online reputation not only attracts new customers but also reassures existing ones of their choice, fostering a sense of reliability and confidence in your services.

Developing a strategy focused on transparency and customer engagement can transform the public perception of your insurance company. Encourage satisfied customers to leave positive reviews and testimonials on various platforms, including your website and social media channels. Engage constructively with feedback, addressing concerns and demonstrating your commitment to customer satisfaction. Additionally, leveraging content marketing to share insights, advice, and industry news can position your company as a thought leader, further establishing trust with your audience. By consistently providing value and demonstrating integrity, insurance companies can build a reputation that stands the test of time and volatility in the market.

- Encourage Customer Reviews: Make it easy for clients to leave reviews by sending follow-up emails after purchase or service encounters and providing links to your review pages.

- Respond to Feedback: Address both positive and negative feedback publicly and professionally, showing that you value customer input and are committed to improving service.

- Showcase Success Stories: Share customer success stories and case studies that highlight the benefits of your insurance products and services.

- Maintain Active Social Media Profiles: Use social media to share valuable content, interact with your audience, and humanize your brand.

- Educate Your Audience: Regularly publish informative content that helps demystify insurance concepts, showcasing your expertise and building trust with potential customers.

improve your marketing today

Throughout this article, we've explored a variety of actionable marketing tips specifically tailored for insurance companies, emphasizing the critical role of understanding your target audience, leveraging digital marketing, investing in CRM tools, utilizing data and analytics, and building a strong online reputation. Each of these strategies plays a vital part in crafting a marketing approach that not only reaches potential customers but also resonates with them on a personal level, encouraging engagement and loyalty. The importance of a user-friendly, SEO-optimized website, the power of social media and content marketing, the insights gained from CRM analytics, and the trust built through a strong online presence cannot be overstated. Together, they form the backbone of a dynamic, effective marketing strategy that can propel your insurance company to new heights.

As we conclude, it's crucial to remember that the insurance market's competitive landscape is constantly evolving. Staying ahead requires not just adopting innovative marketing strategies but also continuously refining them based on data-driven insights and the changing needs of your audience. The future belongs to those who are willing to embrace change, experiment with new approaches, and always put the customer at the center of their marketing efforts. By doing so, your insurance company can not only survive but thrive, securing a prominent place in the hearts and minds of consumers in an ever-competitive industry.

Buy This website Template

Website template for an Insurance Company

- Professional and Trustworthy Design

- Client-Centric User Experience

- SEO-Optimized for Maximum Visibility

- Responsive and Mobile-Friendly

- Content-Ready Structure

Frequently Asked questions

AutomationLinks

AutomationLinks is a digital marketing agency located in Wilmington North Carolina. We have worked with over 6,000 businesses and nonprofits over the last 10 years. We believe in a relationship marketing approach to help you turn visitors into customers using automation.